Introduction

Candlestick trading is a timeless and universal language of markets, used by traders and investors worldwide to navigate the complexities of financial markets. This ancient Japanese technique has evolved into a powerful tool for modern traders, offering valuable insights into market sentiment and trend analysis.

What are Candlesticks?

A candlestick is a graphical representation of a security’s price action over a specific time period, typically consisting of four components:

- Open: The opening price of the security

- High: The highest price reached during the period

- Low: The lowest price reached during the period

- Close: The closing price of the security

A sample candlestick chart showing various candlestick types and patterns

Types of Candlesticks:

Candlesticks come in various shapes and sizes, each conveying unique information about market dynamics. Here are some of the most common types:

– Bullish Candle: A candle with a closing price higher than the opening price, indicating buying pressure.

– Bearish Candle: A candle with a closing price lower than the opening price, indicating selling pressure.

– Doji Candle: A candle with a nearly equal opening and closing price, signaling indecision or a potential trend reversal.

Candlestick Patterns of Trade

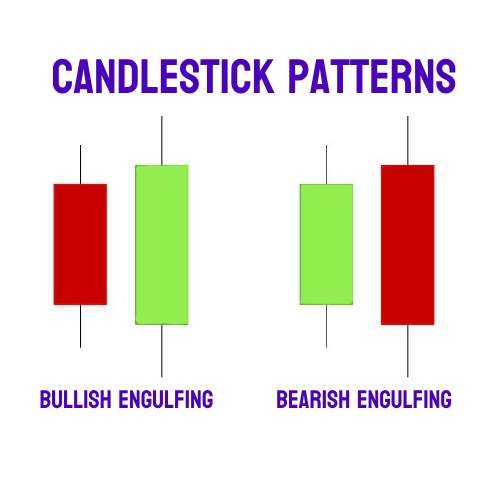

Candlestick patterns are combinations of individual candles that reveal valuable information about market trends and reversals. Some popular patterns include:

– Bullish Engulfing: A bullish candle that engulfs a preceding bearish candle, signaling a potential trend reversal.

– Bearish Engulfing: A bearish candle that engulfs a preceding bullish candle, signaling a potential trend reversal.

Conclusion:

Candlestick trading offers a unique perspective on market analysis, providing valuable insights into market sentiment and trend dynamics. By mastering various candlestick patterns and types, traders can enhance their trading strategies and make more informed investment decisions. Whether you’re a seasoned trader or a beginner, candlestick trading is an essential tool to add to your trading arsenal.